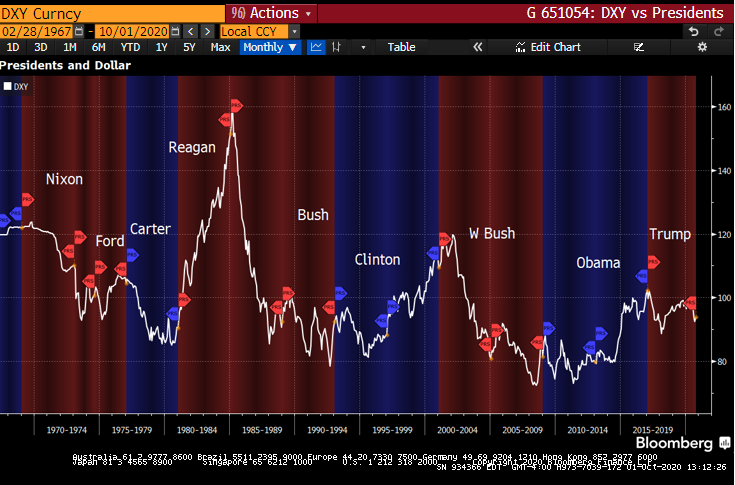

As part of our ongoing monitoring of the FX markets for our clients—we spotted this chart on Bloomberg’s live FX blog.

Recently we have been getting the same question from our clients and prospects—do presidents affect the buck, and how will Biden/Trump turn out for its value?

This graph illustrates what we have been saying for months that it does so in a non-partisan way. With the election just over a month away, it is reasonable to expect heightened volatility with a bearish dollar slant.

In Bloomberg’s quick take below, it follows our same line of thinking and reverberates our overall narrative. The dollar is likely to maintain weakness, especially as infrastructure spending is expected from one or the other.

As always, your top-Bloomberg ranked currency forecasting team and Monex account managers are available to answer any questions you have as we approach the election to best manage your FX risk.

Dollar May Weaken Under a Biden White House

October 1, 2020 (Bloomberg) — There’s a consensus that a Blue wave in which the Democrats take over both houses of Congress and the presidency would boost spending and widen deficits. That, in turn, would weaken the dollar. It would also fit the pattern that the dollar tends to embark on a major trend reversal whenever one party replaces another in the White House.

For instance, Ronald Reagan’s first term saw the dollar start a multi-year rally after Paul Volcker broke the back of inflation. The greenback surged again under Bill Clinton as productivity gained and debt fell, until George W Bush took over and widened the deficits. The greenback carved out a bottom and climbed during the Obama era. It’s been consolidating since then.”

ARTICLE By Ye XiE, Bloomberg

Ready for FX solutions to finish out 2020 strong and prepare for 2021?