The U.S. dollar continues to stumble as the Bloomberg Dollar Spot Index is set for its fifth consecutive day of declines.

Overview

If the move holds, it will be the worst run since November. The dollar declined a touch yesterday after data showed that inflation is not running as hot as many had feared. Indeed, headline and core consumer inflation numbers came right in line with expectations.

In a speech to the Economic Club of New York, Fed President Jerome Powell did not blink in his promise to keep loose monetary policy over the medium term. He also said that the U.S. jobs market remains far from a full recovery, further making the case that fiscal spending is needed to complement monetary policy.

Global equities are nearly all in the green today, which has added more downward pressure on the greenback.

This morning’s jobs data will add to the argument that fiscal stimulus is needed. Weekly jobless claims registered at 793K jobs last week, more than the estimated 760K jobs. Adding insult, last week’s claims were upwardly revised from 779K to 812K.

Numerous Asian markets are closed ahead of the Lunar New Year holiday, leading to less liquidity in currency markets.

What to Watch Today…

- No major events scheduled for today

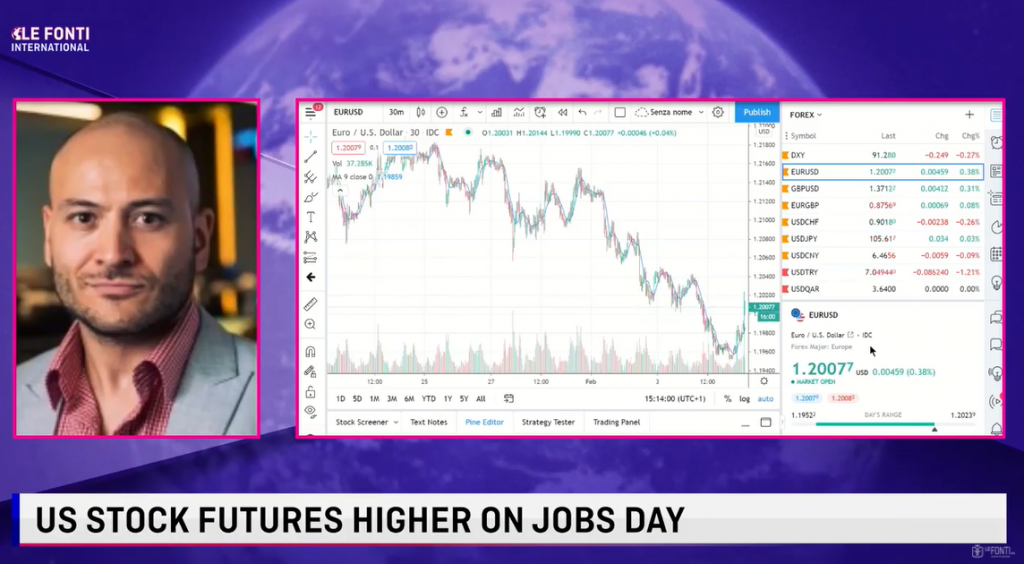

Listen to the latest FX news with Juan Perez on LeFonti International TV

EUR ⇑

The Euro ticked slightly higher against the U.S. dollar, continuing its positive momentum. There was little in the way of economic data released in the Eurozone. However, the European Commission cuts its forecast for Euro area growth. The EC forecasts GDP will only be 3.8% this year, lower than a previous estimate of 4.2%. On the bright side, the EC predicts the economy will reach its pre-covid level of output faster than previously anticipated. The EC pointed to the expectation that vaccine distribution in the EU should improve.

CAD ⇑

The Canadian dollar is making strides against its American counterpart this morning. The loonie advanced 0.3%, pushing the Canadian dollar to its strongest level since January 22nd. The bullish move for the loonie comes even as the price of oil retreated overnight. The International Energy Agency cut its forecast for oil consumption this year by 200K barrels a day. While WTI fell half a percent, oil prices remain close to their one-year high.

Ready to spin the currency market moves in your favor?