Monthly Currency Outlook

February 2026 Currency outlook

What Happened

- Following a slight decline in December, the U.S. Dollar’s bad fortunes continued into the new year with a 1.3% drop per the Bloomberg Dollar Spot Index

- All G-10 currencies gained over the Buck, marking the best performance for this group since April of last year and worst January for the DXY-Index since 1973

- €uro and Pound Sterling reached their strongest levels in four years with growing concern over security pacts

- Currencies around the Pacific Rim surged with JPY climbing to its highest cost since October while Antipodeans AUD & NZD jumped multi-month highs

- January witnessed Mexican Peso strengthening taking the rate to its best against USD since end of May 2024

Monex USA’s View

- February began with a partial U.S. government shutdown that will delay data releases including key labor gauges imperative for Fed decision-making

- Chairman Jerome Powell will continue in his role as Fed Chairman, but expect more questions about Kevin Warsh’s thinking ahead of May changes

- Geopolitical headlines will keep FX volatile as the U.S. diplomatic developments also result in announced trade deals or imposing of tariffs

- Lack of visibility and transparency regarding economic indicators are likely to cause a downward effect for the U.S. Dollar

- MSCI Emerging Markets Currency Index may continue hitting records as metals prices rise

IN FOCUS

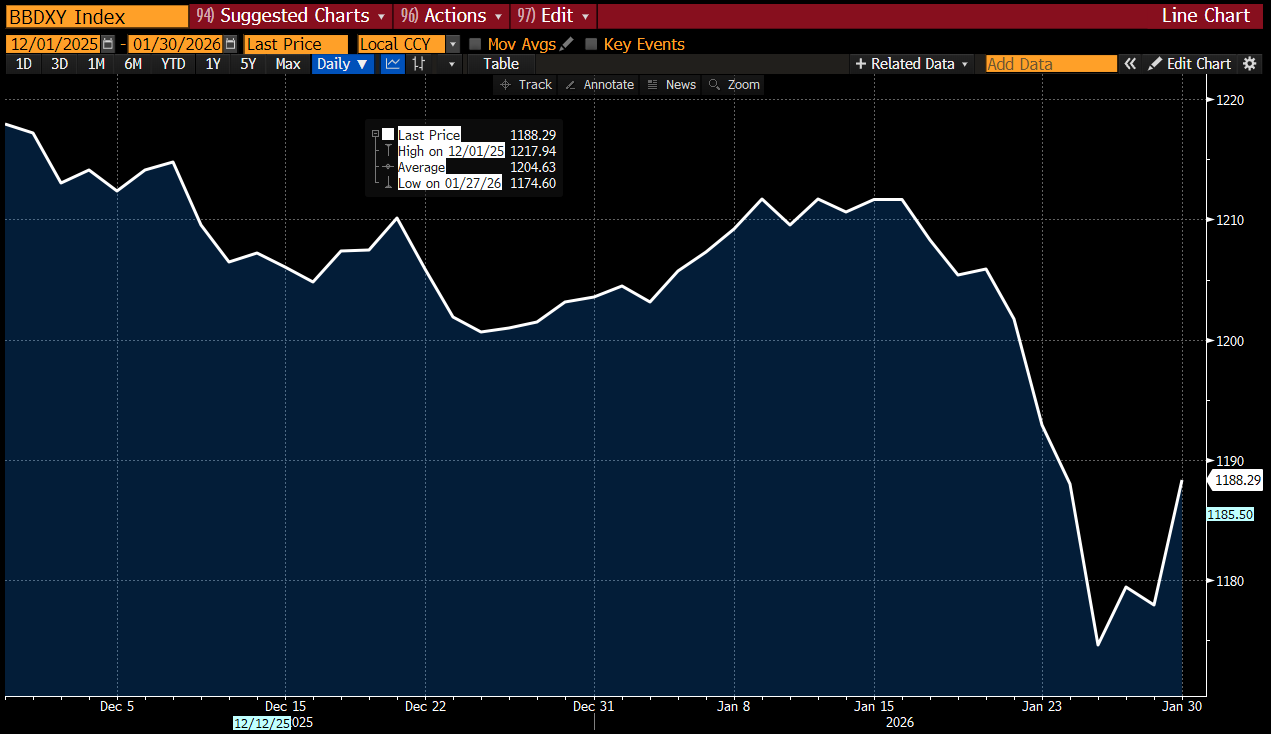

BDXY: Buck weakness is no joke, stumbling by 2.5% since start of December 2025

(Bloomberg chart shows how the end of January saw a collapse for the Buck even after Fed left rates unchanged)

USD-weakening has not gone away even after a bit of a break in Q4, when the BDXY came in ‘flat’

- 2025 was not kind to the Dollar and 2026 is not looking that much different with most currencies gaining and a “Sell America” trend taking place

- Rhetoric over potential U.S. takeover of Greenland increased tensions between the U.S, Europe and the U.K. with the N.A.T.O. alliance questioned

- Tensions in the Middle East, particularly over Iran’s nuclear program and street protests, have affected oil prices and speculation, driving the Buck down

- Lack of clarity over legality of tariffs keeps idiosyncratic moves for USD based on relationships

THE VIEW — Greenback debasement may continue if negative tendency stays

U.S. Dollar’s status as the Go-To currency may be fading

Keeping away from the U.S. Dollar is an ongoing development that was exacerbated by the COVID-19 pandemic. Indeed, 2019 was the last time that USD’s share of global foreign exchange reserves stood at 60.0% or higher. After dropping in value by around 11.0% overall in 2025, 92.0% of the reduction in Dollar reserves was due to the quick depreciation experienced in the second quarter of last year when it collapsed by 7.0%. Additionally, fiscal deficits are reaching levels that are of high concern with the U.S. gross national debt officially surpassing $38.0 trillion in Q4 2025. The long-held status as a safe-haven asset has been challenged by Euro, Yen, as well as Gold.

(Bloomberg chart shows the MSCI Emerging-Markets Currency Index reaching an all-time record high)

2026 began with a bit of shock and awe as a quickly executed U.S. military operation concluded in the capture of Venezuelan dictator Nicolas Maduro, initially boosting the Buck’s value after such a display of strength.

However, things turned around for the Dollar following an increase in tensions over other possible missions that included the idea of attaining Greenland, a territory administered by Denmark. North Atlantic Treaty Organization (N.A.T.O.) members and their leadership emphasized such a takeover would violate current security agreements and norms. Negotiations and talks have been proposed on the sensibility of the matter.

Although stress on that front has eased after Davos, January also brought into the mix the announcement of subpoenas handed to the Federal Reserve as part of an investigation over government building innovations. This caused a surprise reaction statement from Fed Chairman Jerome Powell who defended the central bankers’ dealings and previous testimony to Congress on the subject. Ultimately, this was perceived as a destabilizing factor for USD, worrying investors and traders about compromising the Fed’s autonomy and independence while attacking its credibility.

The negativity surrounding the U.S. Dollar and loss in faith in holding it as a staple of reliability are hard to shake with incomplete economic guidance and long-term deterioration in some indicators. January was the 28th consecutive month of contraction for Employment in Manufacturing, something not experienced since the days of the Great Recession between 2008 and 2009.

When it comes to labor data, we are navigating blindly. Congress has been working on coming up with a spending package, but the inability to reach a majority forced a partial shutdown that affected the analysis and collection of statistics. This goes back to Q4 when the original havoc of closing the government for the longest period ever delayed other releases. At least from private gauges, we can gather that excluding the pandemic, the U.S. had the weakest job expansion in years. 2025 represented the smallest annual growth since 2003.

As February started, China’s President Xi Jinping spoke about the country’s goals of becoming more influential across the globe, shifting away from the “Wolf Warrior” diplomatic approach and being friendlier and less aggressive as well as assertive. More importantly, he spoke about the Chinese Yuan (CNY) becoming more crucial to international trade and his desire for it to rise as the most desired reserve currency. There is certainly room for enlargement as CNY’s share of global holdings stands at just 1.93%, down from a peak hit in 2022 of 2.2%.

With the Euro-zone drifting away from decoupling from China and integrating more by solidifying commercial ties, the Euro could jump in value after already touching a 4-year best. It is difficult to envision much chances for U.S. Dollar recovery, especially as American data keeps getting postponed. There are a few silver linings worth noting such as New Orders increasing to their highest level since February 2022 plus the first expansionary reading for the Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index in a year.

We think Buck troubles are going to be sticking for some pairs, but against the Japanese Yen. Elections taking place on Sunday February 8th will determine if Prime Minister Sanae Takaichi can consolidate power and have little to no legislative opposition. It is possible a strong decline could trigger more committed talks about FX intervention. Watch out for how metals and materials keep Emerging-Market tender attractive.

Ready to optimize your FX with our award-winning trading team?

BOOK AN INTRO MEETING OPEN A FREE ACCOUNT