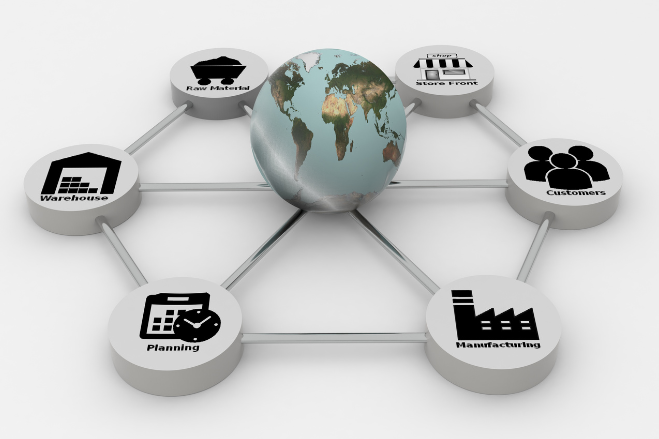

The textile industry operates on a global scale, with raw materials sourced from one continent, manufacturing in another, and buyers spread across the globe. This interconnected supply chain makes international payments a crucial component of doing business, not just a back-office operation. For textile companies, managing cross-border payments effectively can mean the difference between protecting profit margins and facing unnecessary losses.

At Monex USA, we specialize in helping textile companies—importers, exporters, and manufacturers—overcome the challenges of managing international payments for textile companies in an increasingly volatile foreign exchange (FX) market. With our advanced tools and expert guidance, we help businesses save money, reduce risk, and stay competitive.

The Role of International Payments in the Textile Industry

Textile supply chains are inherently global, involving multiple FX-sensitive touchpoints:

- Sourcing raw materials like cotton, wool, and dyes from countries such as India, Bangladesh, and China.

- Outsourcing manufacturing to regions with favorable labor costs, like Vietnam or Pakistan.

- Exporting finished goods to buyers in markets like the U.S., Europe, and Australia.

Every step involves currency exchange, which adds complexity to operations. Delays, hidden fees, and FX volatility can significantly impact bottom lines. Whether you’re a U.S.-based apparel brand sourcing fabric from Turkey or a Bangladeshi factory exporting to retailers in Europe, getting international payments right is critical to maintaining a competitive edge.

Top Challenges in Managing International Payments for Textile Companies

1. FX Volatility and Profit Margins: Global currency rates fluctuate daily, and even minor shifts can have a massive financial impact. For textile companies with slim margins, an unfavorable FX movement can wipe out profitability. For example, a 1% currency fluctuation on a $1 million deal can cost $10,000—money that could otherwise be reinvested in the business.

2. Payment Delays and Supply Chain Disruptions: Outdated banking systems, local regulations, and mismatched time zones can delay payments. Late payments not only disrupt production timelines but can also damage supplier relationships, putting your business at risk of losing key partners.

3. High Transaction Fees: Frequent international payments through traditional banks often come with high transaction fees, exchange rate markups, and hidden costs. For textile companies making frequent payments, these fees quickly add up and eat into profits.

4. Invoicing and Compliance Complexity: Managing invoices in multiple currencies, complying with local financial regulations, and handling tax documentation add an administrative burden and increase the risk of errors.

How Monex USA Solves These Challenges for Textile Companies

At Monex USA, we understand the unique needs of the textile industry. Our global payments solutions are designed to simplify cross-border transactions, reduce costs, and protect businesses from FX volatility. Here’s how we do it:

Competitive FX Rates and Hedging Tools: We offer competitive FX rates that save you money compared to traditional banks. With forward contracts, you can lock in favorable exchange rates for future payments, protecting your budget from market volatility.

Faster Cross-Border Payments: Our cutting-edge technology ensures faster, seamless international transfers, so your suppliers get paid on time, in their local currency. No more delays disrupting your supply chain.

Multi-Currency Accounts and Bulk Upload: Manage multiple payments in multiple currencies without the need for multiple foreign bank accounts. Our platform simplifies operations, letting you focus on growing your business instead of juggling financial complexities.

Expert FX Guidance: Our dedicated FX specialists work closely with you to assess risks, identify trends, and develop custom FX strategies tailored to your business. Whether you’re hedging against currency volatility or optimizing payment schedules, we’re here to help.

Customer Success Story: 80% Faster Payments Processing

A North Carolina textile company sources fabric from Asia, Europe, and South America, making monthly payments to over 200 suppliers in more than 15 currencies—a total of $5 million each month. By adopting Monex USA’s Bulk Upload Solution, the company streamlined its multicurrency payment process, reducing processing time by 80%. This upgrade not only saved $45,000 annually but also strengthened supplier relationships through accurate and timely payments.

Future-Proofing Textile Businesses with Smarter Payments

As textile companies digitize their supply chains, managing international payments effectively is more important than ever. Cloud-based platforms, API integrations with ERP systems, and AI-driven FX strategies are becoming essential tools for staying competitive.

Monex USA leads the way by providing advanced payment solutions that reduce FX risk, simplify operations, and strengthen supply chain relationships. With our help, textile companies can adapt to market changes while protecting their profit margins.