The U.S. Dollar is trading in weak ranges to close out the week before holidays begin to take attention as well as liquidity away from the market.

Overview

Overall, the Buck has dwindled in December, falling by 1.7% in value thus far into the month. Most of the credit has to be given to an optimistic outlook for 2024 that is pricing in a soft landing in which the economy will continue to steadily grow as borrowing costs start to go down. With the tightening cycle over for the Fed, the buck has taken a natural hit and data seems to present further evidence of the trend.

Earlier releases of Personal Income as well as Spending improved as expected and picked up from the month prior. Meanwhile, the Price Consumption Expenditures (PCE) Deflator for the month actually contracted unexpectedly by (-0.1%) and Durable Goods Orders revealed a tremendous comeback, which had contracted in October by (-5.1%) and returned to 5.4% gains in November. In general, this plays to the tune of forecasts that see the economy holding to strength while the Fed watches carefully for any signs that may lead to policy considerations. Things are not necessarily too hot to handle so from now on, it is a game of watching out for what declines, and if so, how quickly.

What to Watch Today…

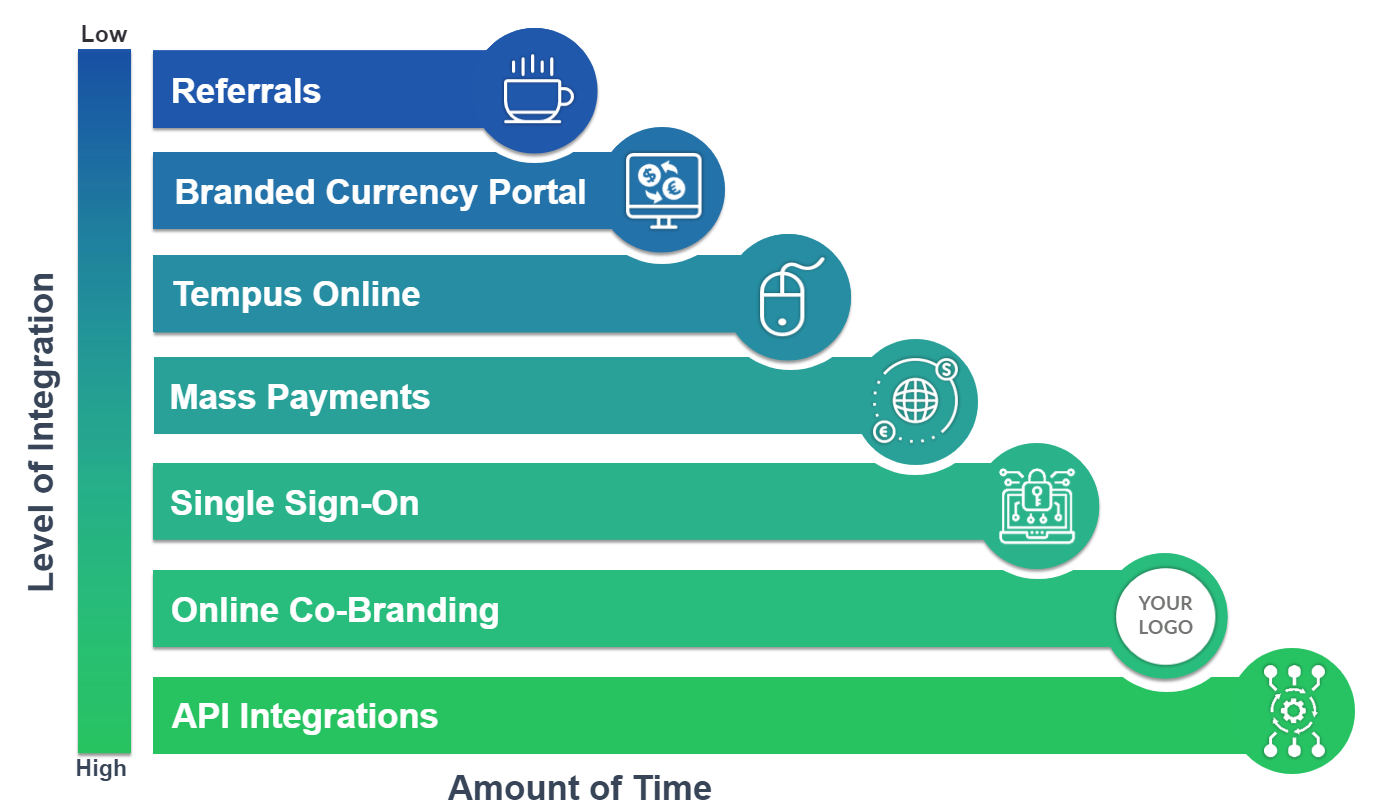

Discover the flexibility of partnering with Monex USA— we provide your desired level of FX support and integrations based on your current and future needs. All levels of our FX solutions are designed to save your business time and money and to exceed your expectations for transacting globally. Learn more

GBP ⇑

Sterling also rose for the week, but unlike the European Union, there are bad predictions for the United Kingdom. While Bank of England Governor Andrew Baley has commented on the need for markets to lower their expectations of interest-rate cuts, economic data has pointed at contractionary developments and many economists feel that the U.K. has been lucky to avoid a deep recession that shall manifest in 2024. If so, Pound could usher in the new year crashing a bit as traders put together a picture of how things will play out. If they avoid trouble, perhaps these levels can remain, but it is in doubt.

EUR ⇑

The Euro had a stellar week, climbing by 2.2% as markets have punished the Dollar as Fed mentality has changed. Ongoing price growth in Europe continues to keep European Central Bank officials committed to a tightening mandate, certainly different from how they had been in previous years. Along with some expansionary trends in Industrial Production and consumption, there is belief in Europe’s ability to mount a strong economic year coming after struggles with post-pandemic shocks and conflicts. We foresaw the Euro’s good fortunes and see these levels merited for now.