The U.S. Dollar is trading in mostly familiar ranges today, continuing to strengthen slightly across the board based on some pessimism over China following underwhelming data.

Overview

Yesterday also saw the second worst reading since 2001 for the Empire Manufacturing survey, which has economists debating whether the Fed will need to rethink its interest-rate hiking mood.Tomorrow’s Fed Minutes should allow traders to get some insight as to how data-sensitive officials feel and if, indeed, dwindling numbers will be enough to have them slow down the pace of rate increments. The biggest risk even revolving around the Fed for this month will come during the 25th-27th as they have their annual symposium in Jackson Hole, WY.

Their policy application has certainly cooled down the Housing sector, with July Housing Starts contracting by (-9.6%) vs. expected (-2.1%) for the month.

What to Watch Today…

- No major economic events are scheduled for today

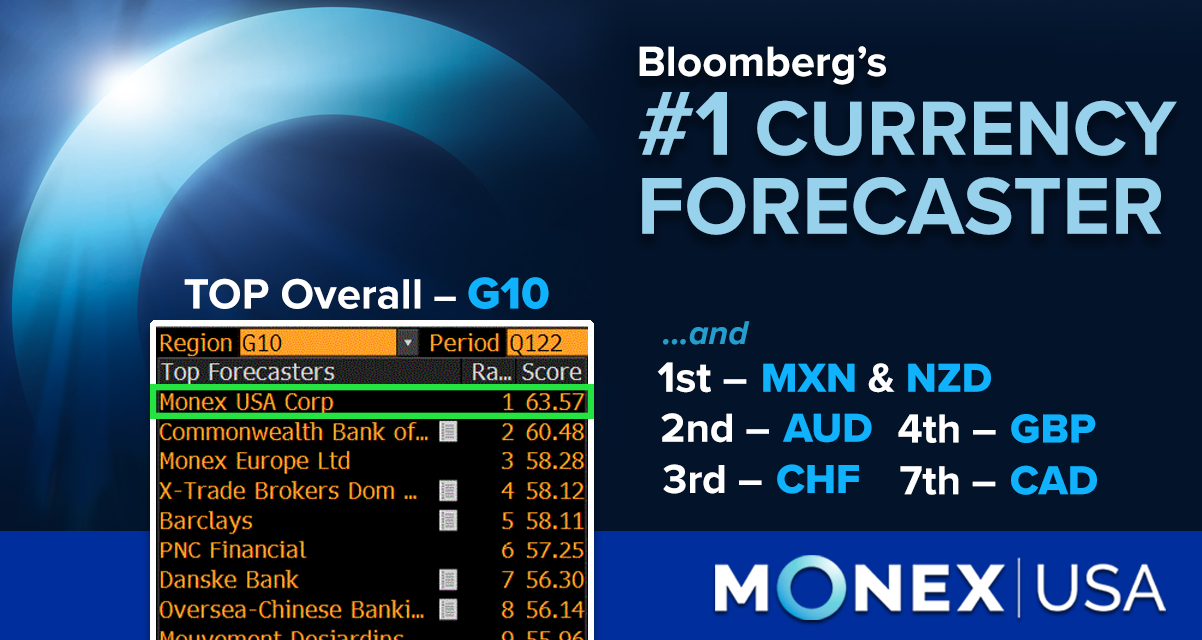

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

EUR

Euro dropped slightly overnight as ongoing pressures from China and the energy crisis add to a negative outlook for the remainder of the year. German newspapers have featured forecasts of dimmer streets and colder buildings coming up this winter.

Indeed, the stagflation from the war and the shock to the interconnectedness of the system is keeping Euro close to the early 2000s low.

GBP

The U.K. economy is able to withstand further interest rate increases per labor sector numbers released earlier in their trading session. Although wages declined at their fastest pace ever between April and June, the labor market is in the midst of a rebalancing that was expected with tighter monetary policy.

The Bank of England is likely going to maintain its mentality, but the global scale of recessionary pressures will keep the buck afloat.