The U.S. Dollar is swinging downward this morning just slightly as traders prepare for tomorrow’s main risk event in the Fed’s policy meeting.

Overview

Later today we get to see more March data in the form of Factory Orders, Durable Goods Orders as well as JOLT Job Openings at 10 AM. We shall see if these numbers reveal expansion after some contraction and low expansion the month prior.

Anything tomorrow that demonstrates hesitation from the Fed could further aid the buck’s current depreciation. At this point, there is no clear dollar guidance with the war and the struggles in the Chinese economy weighing on the globe’s ability to fully recover from already tried pandemic woes.

What to Watch Today…

- No major economic events are scheduled for today

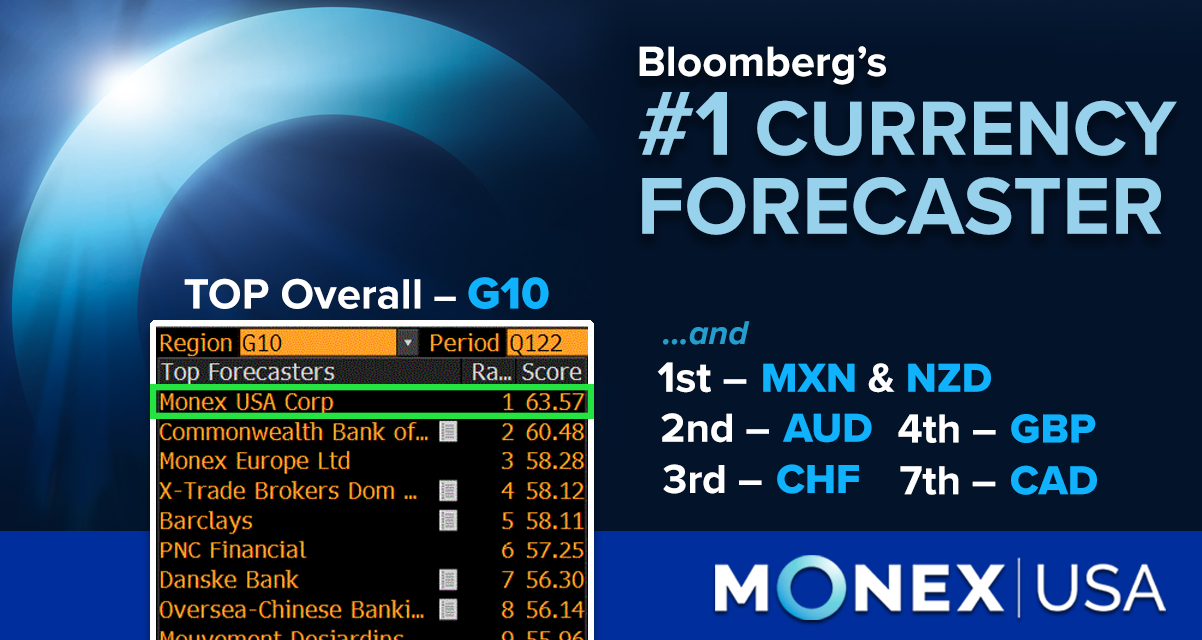

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

EUR

The Euro is trading at stronger levels today as markets land in positive territory ahead of the Fed’s major decision and press conference tomorrow. On the European Central Bank front, officials seem to be considering a rate hike for this year, but President Christine Lagarde has said that increasing rates alone does not guarantee downward pressures on price growth especially when the scarcity is related to energy and other physical capital required for activity.

We shall see if this week turns into one for Euro-gains as markets price-in hikes and the long-term potential of conflict in Ukraine.

AUD

The “Aussie” is mounting a comeback following the Reserve Bank of Australia’s decision to increase interest rates by more basis points than forecast. Officials were expected to increase by 10 points but ultimately it was 25 basis points to 0.35%. As a result, they aided to bring the three-year bond yield to 3.0% for the first time since 2014. We shall see if the Bank of England follows suit on Thursday.

Ready to spin the currency market moves in your favor?

DISCOVER HOW WE CAN HELP YOU SEND or RECEIVE PAYMENTS