The U.S. dollar is mixed this morning. The Bloomberg Dollar Index is up 0.1%, with most of the gains attributed to a fall in the British pound.

Overview

Equity futures are a touch higher even following reports that China fired 11 missiles into the sea around Taiwan. Increased tensions have only played a minor role in global risk appetite so far, but further escalation could see equities tumble and the dollar rally.This morning’s economic data showed that the U.S. Trade deficit narrowed by 6.2% in June, according to the Commerce Department. A separate report showed that U.S. weekly jobless claims rose 6K to 260K, right in line with estimates. The labor market remains one of the few bright spots in the American economy. There is no further economic data set for release today, but Cleveland Fed President Mester will speak at noon. Tomorrow’s Non-farm payrolls remain the largest economic risk event on this week’s calendar.

What to Watch Today…

- No major economic events are scheduled for today

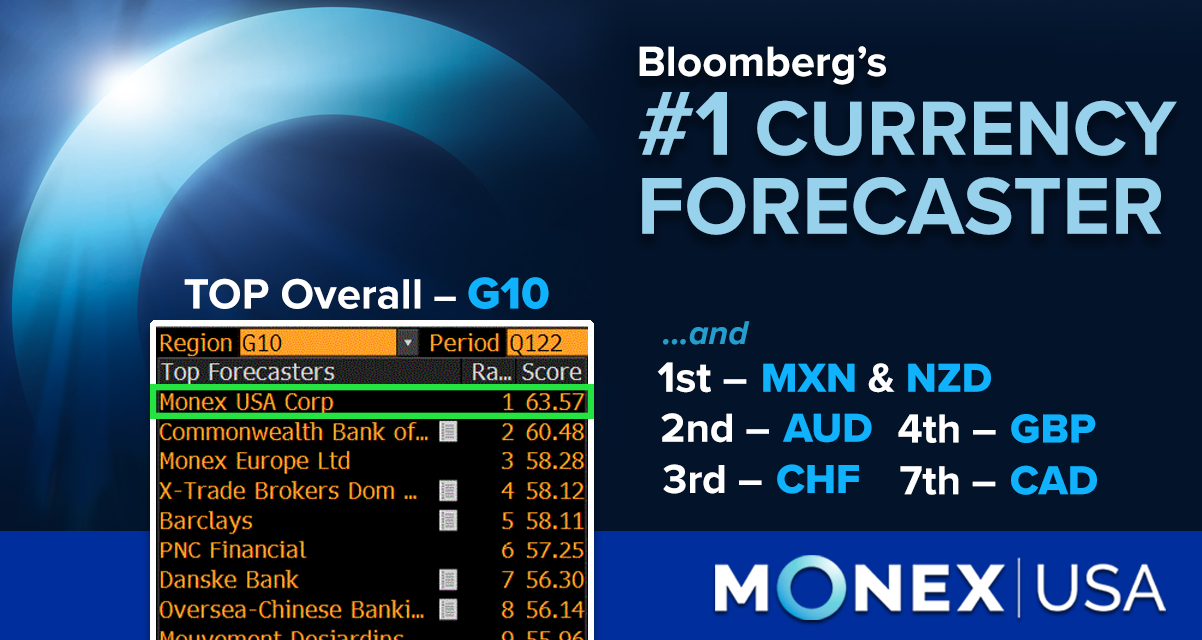

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

GBP

The British pound dumped half a percent against the U.S. dollar in early trading even after the Bank of England hiked interest rates by the most since 1995. The half-point increase was widely expected and brings the rate to 1.75%. The BoE also pledged to continue to act to rein in inflationary pressures.The decline in the pound is likely the result of dire economic warnings from the central bank. The Bank of England said they expect the U.K. economy to hit a recession in the fourth quarter of this year and last throughout 2023. The bank expects the economy to shrink by around 2.1% in total. The gloomy outlook will likely keep the Bank of England from raising rates as high or as fast as the U.S. Federal Reserve, hence the sterling weakness.

AUD

The Aussie dollar popped higher overnight, rallying nearly a full percent. The Aussie has given back some of those gains and stands 0.4% stronger from last night’s close against the greenback. Australia recorded a record trade surplus.

The surplus jumped to 17.7 billion AUD, driven by higher prices in exports such as grains and metals. Second quarter GDP will likely see a boost as a result, driving the Aussie higher.