The U.S. Dollar is a bit quiet this morning as are most things in relation to markets with Australia, Hong Kong, Europe, and other areas of the world still observing the Easter holidays.

Overview

The buck has been mostly strengthening following a week that did not get closer to a peaceful resolution to the Russia/Ukraine war and revealed strong fears of recessionary pressures ahead. Most certainly, the conflict has created more urgency and fomented more uncertainty as the economic growth of the globe seems to be doomed to be under potential as long as there is no peace.Billionaire Roman Abramovich, the famous Russian former owner of London’s Chelsea Club, Champions of Europe, is reportedly working on negotiating a solution between Moscow and Kyiv. Meanwhile, the energy crisis continues with U.S. natural gas priced at a 13-year-high based mostly on the global supply crunch. Additionally, oil prices hit a new high following news of protests and strikes halting production in OPEC+ member Libya.We shall see if this day serves as another booster for the buck because although it is quiet out there, St. Louis Fed President James Bullard will be speaking later this afternoon. Bullard has been an active voice in promoting quicker Fed interest rate hikes.

What to Watch Today…

- No major economic events scheduled for today

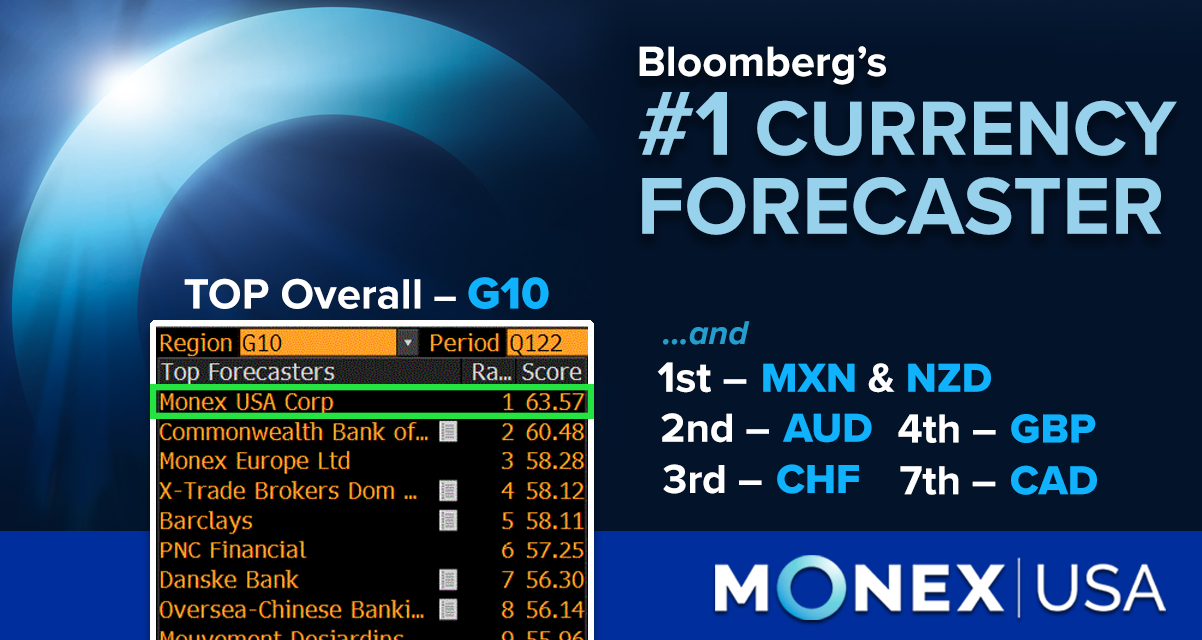

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

EUR

The Euro remains volatile, but it is not full of action today as most participants continue their Springtime and Easter vacations. While the intensity of war escalates, there are some proactive actors who intend to negotiate a resolution. The isolation of Russia has not necessarily convinced Vladimir Putin Russia will suffer long-term devastation, but soon there could be an inevitable break-up with Europe when it comes to what matters most: energy exports.As Russia demands payment in Russian Rubles (RUB) for its production, the violation of financial sanctions that represents will force European nations to call for an embargo as nothing can be exchanged officially. On a positive note, Italy’s Prime Minister Mario Draghi believes the continent can be independent of Russia’s energy sooner than people think and that trying to get Putin to stop in Ukraine is pointless.

Ready to spin the currency market moves in your favor?

DISCOVER HOW WE CAN HELP YOU SEND or RECEIVE PAYMENTS