On the heels of a dismal day for equities but a banner day for the United States Dollar, markets have – once again – reversed course and the Dollar enters today taking a beating.

Overview

Most major currencies are gaining to the tune of half a percent or more against USD, and US stock indices are set to open higher today as the so-called ‘holiday rally’ regains its steam. US treasuries fell overnight as well, faltering on a big rally over the last week and, oddly enough, moving in an inverse correlation to the dollar than their usual trajectory.

Third-quarter US GDP was released this morning, and the final print came in at 4.9%. While this is still a historically high figure, it’s substantially below the last reading of 5.2% and markets are reading this as dovish. Both price indexes, as well as GDP and PCE, came in below expectations, a further sign that inflation is cooling substantially. Notably, personal consumption undershot expectations quite substantially, growing a paltry 3.1% in the third quarter compared with market expectations of 3.6%. This is a substantial step down from the second quarter spending spree that consumers went on – whether it be buying tickets to Taylor Swift, Beyonce, or Barbie, it appears the summer is over and consumers are returning to their typical spending habits. Normalization is undoubtedly a good thing for the economy, but it spells bad news for the dollar, firmly in a winter chill.

Still to come this week is UK GDP tomorrow morning, slated to show zero growth for the third quarter of this year. US PCE Deflator Index is also due out tomorrow morning, but if this morning’s release is any indication, this is also likely to surprise the downside.

What to Watch Today…

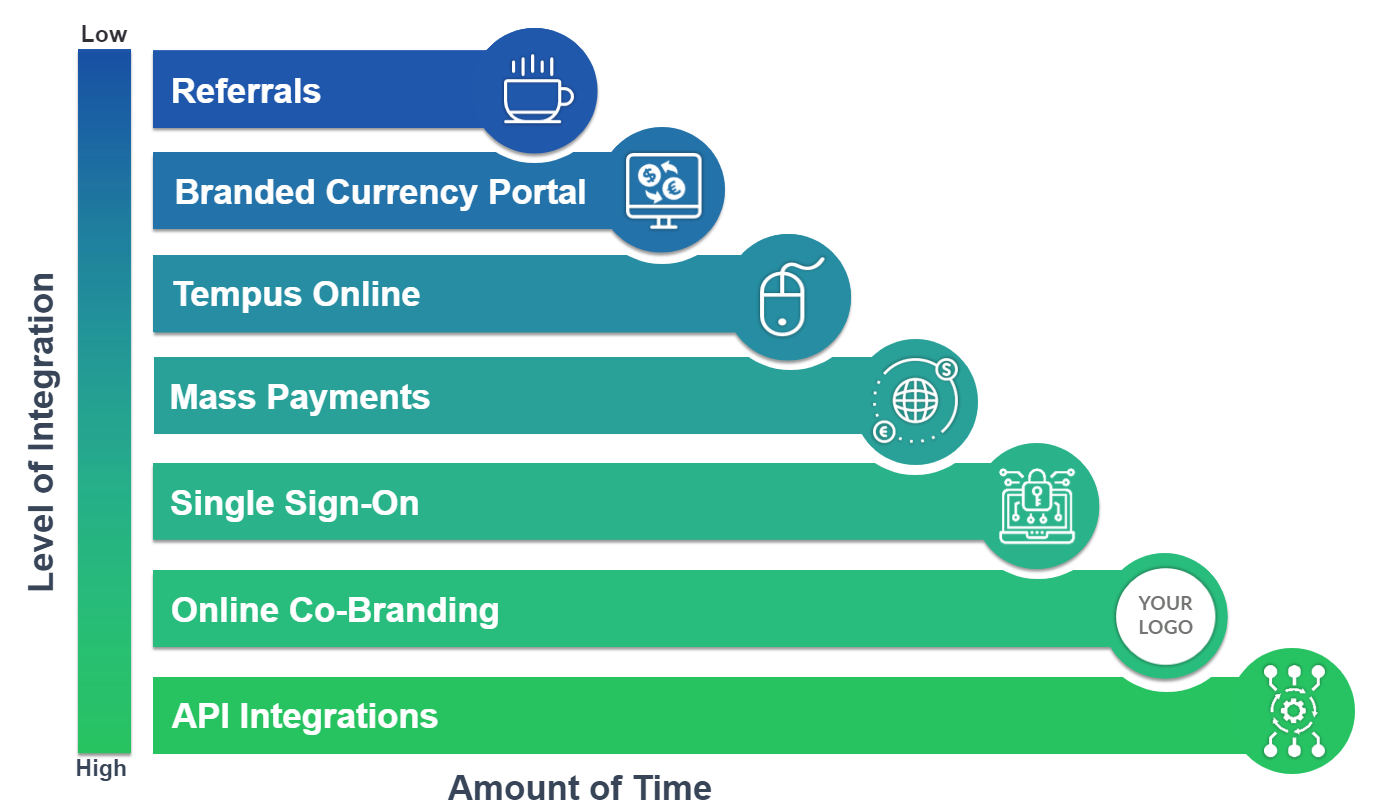

Discover the flexibility of partnering with Monex USA— we provide your desired level of FX support and integrations based on your current and future needs. All levels of our FX solutions are designed to save your business time and money and to exceed your expectations for transacting globally. Learn more

USD ⇓

The Swiss Franc has been on quite an impressive rally as of late, yesterday reaching its strongest level against the USD since July and continuing to gain this morning to the tune of a further half a percent. Since CHF’s weak point for the second half of this year in early October, the traditionally risk-averse currency has gained an unprecedented 7.5% against USD, outpacing its European peers. Global risk events continue to be a strong driver for the currency, and as tensions in the Red Sea continue to ratchet up, CHF has further room to improve.

EUR ⇑

The single currency retraced yesterday’s losses to return to similar ranges from the last week, gaining just shy of half a percent to open the morning. As European traders begin to leave the office for their Christmas holidays, volumes are some 30% lower than average this morning and price action is quite choppy. EUR this morning is being driven not by any data or speakers from the region itself, but rather from general Dollar weakness.