While the holiday euphoria continues to ride high for US equities in particular, the United States Dollar is once again on the losing side today.

Overview

Volume flows are still thin and trading is choppy, but with a decidedly negative tinge for the Buck. The S&P is flirting with an all-time record high, by contrast, as investors cheer the possibility of an interest rate cut from the Federal Reserve as soon as March. We still believe that a March policy change toward easing is much too early and there is quite a bit of potential for a Dollar rally if and when such action does not materialize, but as it stands now, USD is roughly two-tenths of a percent weaker across the G10 board.The big question for next year for most major central banks is not if, but when they see it appropriate to cut interest rates. As we’ve highlighted for the last few months, while the fight against inflation is not necessarily finished in the US or Europe, the larger-scale economic pictures for the two regions are quite different. Domestically, it appears – for now- that Powell and the Fed may have been able to engineer the mythical ‘soft landing’ for the US economy, and while there are some warning signs out of the manufacturing sector in particular, the macro picture remains surprisingly strong. As it stands now, the European and UK economies are in a much more precarious state and we believe this will force their respective central banks to cut interest rates both before they are fully ready and before the Fed does so.With a barren economic calendar to close out 2023, the fortunes of the USD are not likely to turn until the global holiday cheer wears off and 2024 gets moving.

What to Watch Today…

- No major economic releases are scheduled for this week

- Monex USA Online is always open.

- Monex USA office closed on Monday, January 1st

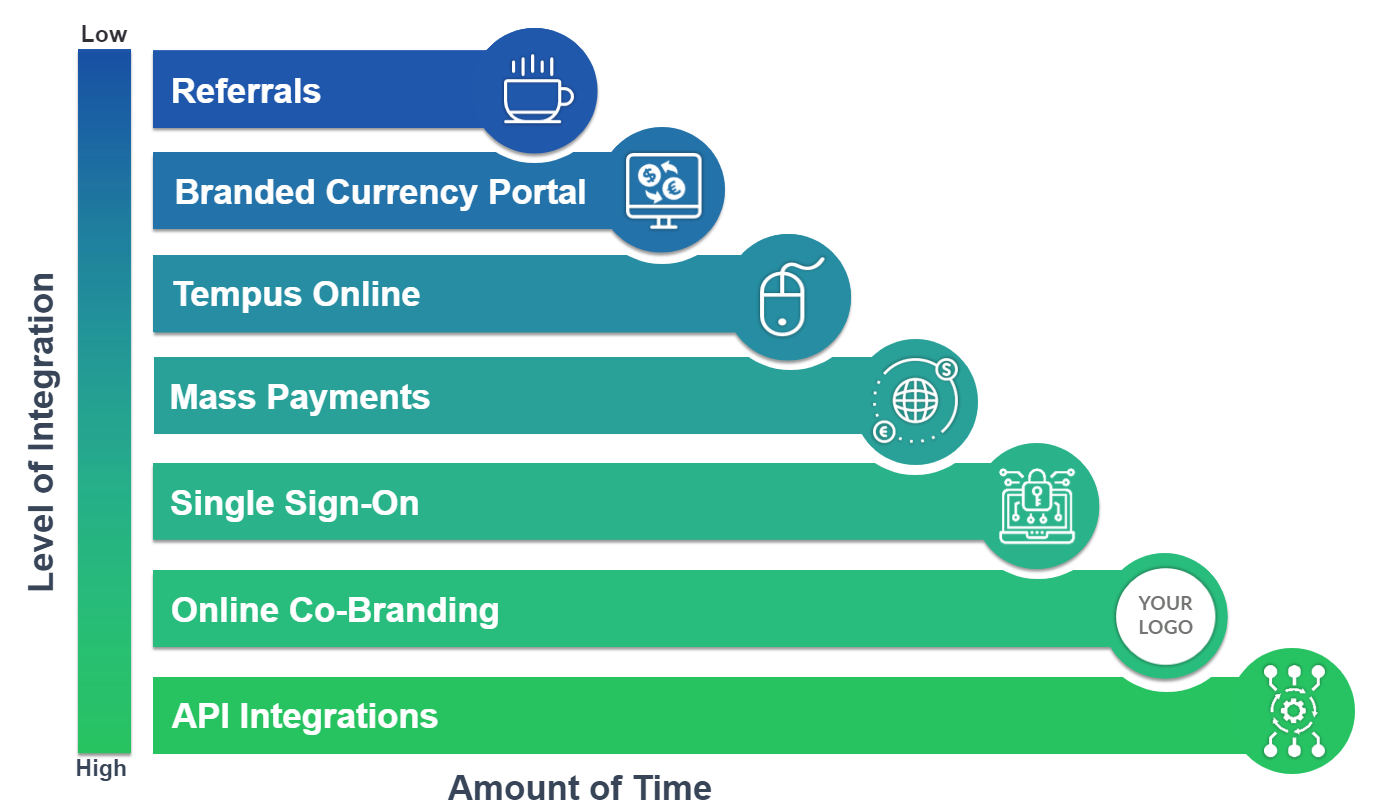

Discover the flexibility of partnering with Monex USA— we provide your desired level of FX support and integrations based on your current and future needs. All levels of our FX solutions are designed to save your business time and money and to exceed your expectations for transacting globally. Learn more

JPY ⇓

Japanese Yen this morning is standing alone as the only currency on the G10 board weakening against the Dollar after one board member of the Bank of Japan indicated that the central bank indicated that ultra-lose monetary policy is more likely than not to continue. Any possibility of a removal of their historic negative interest rate policy in January has essentially been taken off the table, showcasing the BoJ’s traditional very cautious hand.

EUR ⇑

The single currency this morning hit its strongest rate against the USD since July 27th, a continuation of last week’s trend. Much of the Euro’s rally for this calendar year has come in the last few weeks, after Christine Lagarde pushed back on any possibility of interest rate cuts early next year, directly contrasting with Jerome Powell’s more dovish stance. Whether these espoused paths materialize, however, remains to be seen and Q1 promises further volatility for EURUSD.