The U.S. dollar advanced for a fifth consecutive day.

Overview

The Bloomberg Dollar index rose an additional 0.4%, while the Euro fell to a five-year low. U.S. equity futures are slightly in the green this morning but indexes took a beating yesterday, allowing the greenback to extend gains. Axios Markets points out that the S&P 500 is on track for its worst month since March 2020, at the beginning of the pandemic. The index fell 2.8% yesterday and is down nearly 8.0% this month. Global risk sentiment has been dragged down by Russian aggression, aggressive inflation pressures, increasingly hawkish central banks, sluggish growth, covid lockdowns in China, and a European energy crisis. Traders are looking past the second-tier domestic economic data so far this morning and focusing on developments abroad. However, pending home sales at 10 a.m. deserve some moderate attention. There are no more Fed speakers on this week’s docket ahead of next week’s interest rate decision.

What to Watch Today…

- ECB’s Lagarde speaks at noon

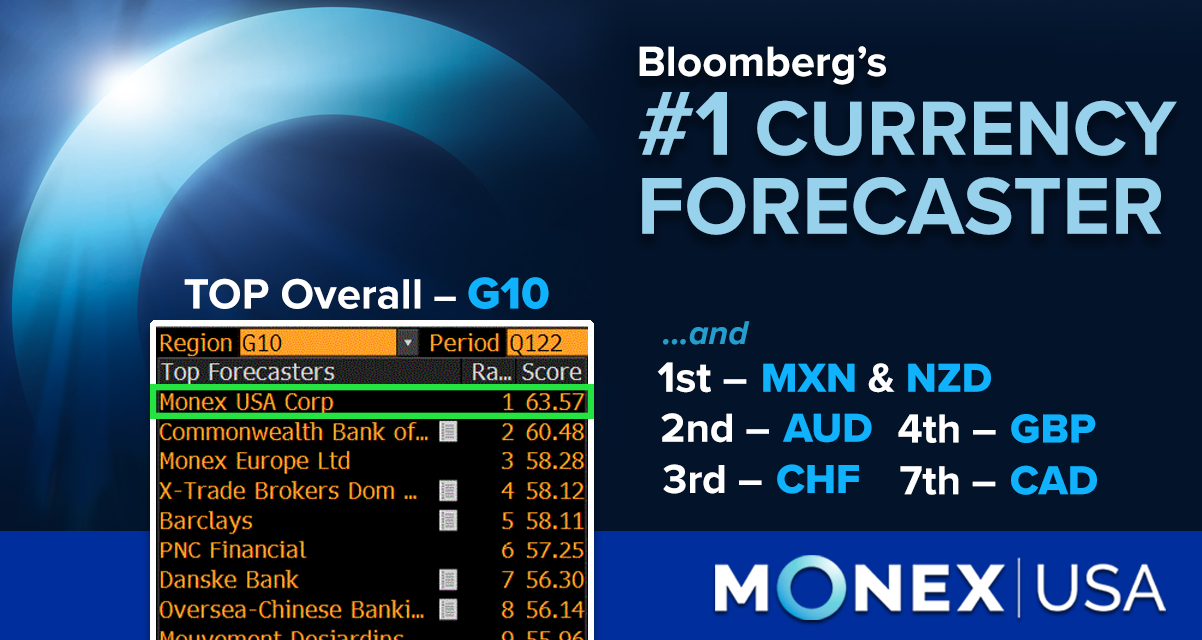

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

EUR

The Euro’s collapse continued overnight and touched a five-year low. EUR/USD fell 0.6% overnight and is down 5.4% over the past 30 days. The European energy crisis worsened after Russia announced that it was cutting off gas to Poland and Bulgaria. Russian President Vladimir Putin had demanded countries pay for gas in Russian rubles and he is making good on his promise to cut off countries who defy his demand. European Central Bank President Christine Lagarde will speak at noon today.

CAD

The Canadian dollar extended losses against its American rival, falling for a fifth consecutive day. The overnight move is likely more U.S. dollar strength than Canadian dollar weakness. Earlier this week Bank of Canada Governor Tiff Macklem said that the bank will consider another half percent interest rate hike at its meeting in June. The Canadian dollar has slipped nearly 3.0% since April 21st.

Ready to spin the currency market moves in your favor?

DISCOVER HOW WE CAN HELP YOU SEND or RECEIVE PAYMENTS