The U.S. dollar is up a touch against most of its G10 rivals, save the Japanese yen.

Overview

Global equities are lower today as tensions have risen between China and the United States. US Speaker of the House Nancy Pelosi arrived in Taiwan this morning, marking the highest-ranking U.S. politician to visit in 25 years. China regards Taiwan as its own territory and has threatened a military response to the visit. This geopolitical event will hold the headlines for the remainder of the week. Risk appetite, and hence the direction of the greenback, will ride on China’s response to Pelosi’s visit.There are multiple Fed speakers on today’s docket that will garner attention. Earnings season will continue today as well. The economic docket is light, with only JOLTS job openings due at 10 a.m.

What to Watch Today…

- JOLTS job openings due at 10 a.m.

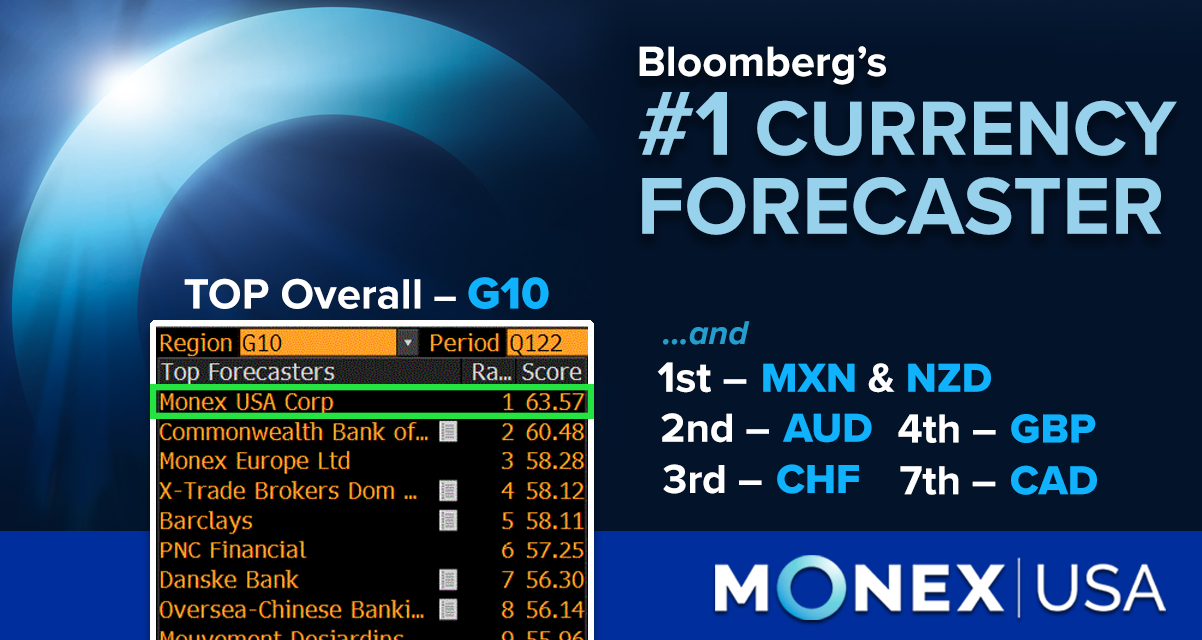

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

AUD

The Australian dollar dumped nearly 1.5% of value this morning after the Reserve Bank of Australia hiked the cash rate by 50 basis points. The hike was expected and represents the third consecutive 50 basis point increase. The cash rate is now at 1.85%. The dip lower for the Aussie came after the statement said that the RBA was not on a “pre-set path.” While future interest rate hikes are very likely, the pace might be slower than previously thought, putting downward pressure on the currency.

GBP

The British pound dipped against the U.S. dollar overnight as the greenback experienced a slight rally. Soft U.K. home price data also put downward pressure on the sterling. However, the sterling remains near a five-week high against its American counterpart. The Bank of England will release its interest rate decision on Thursday morning.

It is likely that the central bank will hike rates by 50 basis points. However, there is a slight possibility the BoE surprises to the downside and only hikes 25 basis points as the U.K. economy faces multiple headwinds. If the hike is only 25 basis points, expect the sterling to lose all the gains it has seen over the second half of July.