The U.S. dollar retreated overnight despite heavy selling of U.S. equity futures.

Overview

The greenback is down about 0.5% against its G10 counterparts. Nevertheless, the U.S. dollar is near or at multi-year highs against many counterparts after an amazing run in April. Shares fared better in Asia after China promised to boost economic stimulus to spur growth, which has allowed some beleaguered currencies to rebound. Yesterday’s advanced reading of first-quarter GDP was a warning sign that the economy is under more duress than previously thought. However, this morning’s economic docket was a bright spot. U.S. March personal spending rose 1.1% month over month, beating estimates of a 0.6% increase. Personal income also beat expectations by rising 0.5% in March.

What to Watch Today…

- No major economic events are scheduled for today

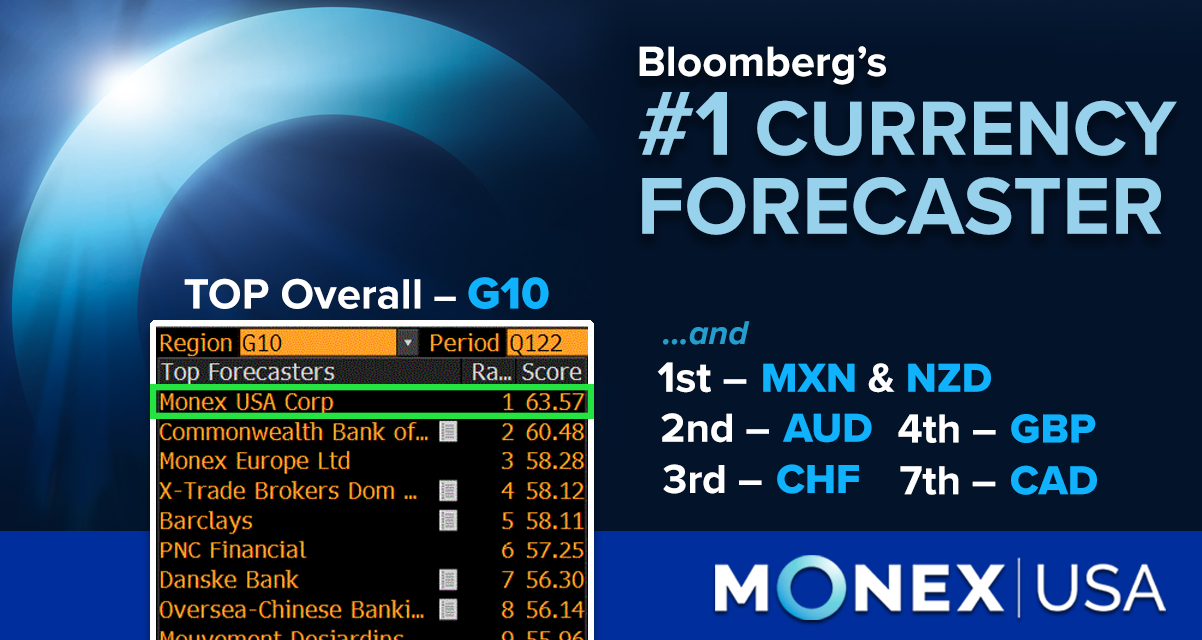

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

CAD

The Canadian dollar joined its G10 brothers by rising against the mighty U.S. dollar. The Canadian dollar is now up three consecutive days versus the greenback after experiencing a rough month. The price of WTI crude rose to 106$ a barrel adding to the loonie’s recovery. The loonie found further support after a report showed Canadian GDP rose 1.1% month over month in February, beating estimates. A breakdown of the report showed output rose in 16 or 20 industrial sectors. GDP is up 4.5% year over year in February.

GBP

The British pound rallied 1% against the U.S. dollar overnight. The relief rally comes after the sterling dumped value for six consecutive sessions. Despite the end-of-month flows that are benefiting the sterling, the currency remains in a precarious position. Recent data has shown that retail sales collapsed in April. Inflation pressures remain and the Bank of England must try to balance slowing growth with elevated price pressures. Markets are pricing in a 25-basis point interest rate hike next Thursday, half of what is expected from the Federal Reserve during the same week.

Ready to spin the currency market moves in your favor?

DISCOVER HOW WE CAN HELP YOU SEND or RECEIVE PAYMENTS