The U.S. Dollar is trading in familiar ranges as low liquidity and activity keep the dollar swinging ahead of the start of 2024.

Overview

In what has been a banner year for stocks, markets are closing out 2023 with hopes that the economy and plans from the Fed will reproduce yet another thriving period. A cooling economy coming from surprising expansion as borrowing costs went up to cause disinflation will determine if it will be necessary for the Federal Reserve to use loose monetary policy to foment an accommodative financial environment.

As for now, the Buck reached its weakest level overall in five months, per the Bloomberg Dollar Spot Index. It is worth noting that the Japanese Yen has climbed to its strongest level since the end of July, while the Swiss Franc is sitting atop the best value since January 2015. These safe havens are getting ahead of the Buck with the belief that they may have room to increase interest rates and take away from the flight to safety toward the dollar if 2024 becomes sour.

What to Watch Today…

- No major economic releases are scheduled for this week

- Monex USA Online is always open.

- Monex USA office closed on Monday, January 1st

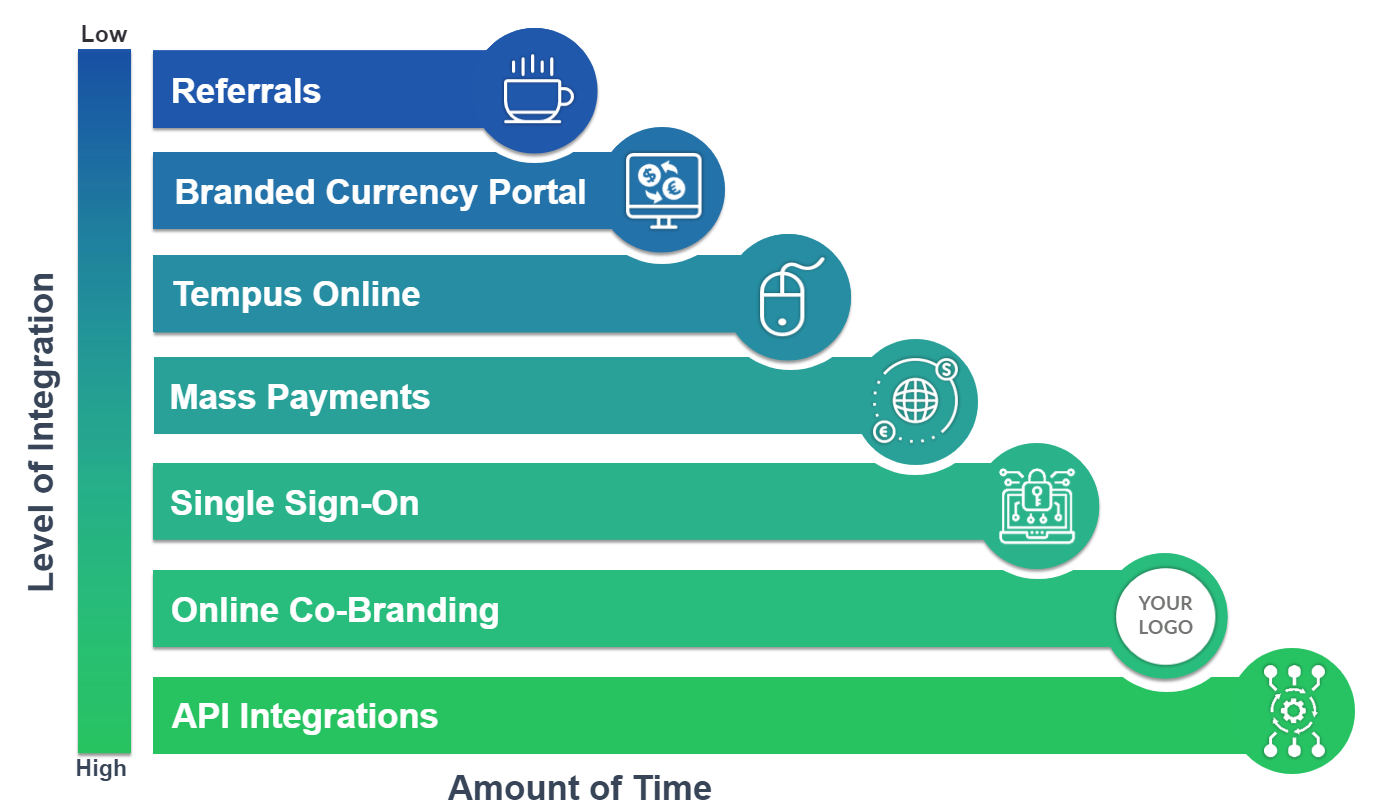

Discover the flexibility of partnering with Monex USA— we provide your desired level of FX support and integrations based on your current and future needs. All levels of our FX solutions are designed to save your business time and money and to exceed your expectations for transacting globally. Learn more