The wait is almost over. Federal Reserve Chief Jerome Powell will give his much-anticipated speech on the economic outlook in Jackson Hole at 10 a.m. EST.

Overview

Running the risk of sounding like a broken record, traders are eagerly awaiting to see how hawkish Powell is at today’s meeting. If he indicates even a touch of dovishness by suggesting interest rate hikes may slow, we could see stocks rally and the dollar decline. A hawkish surprise would have the opposite effect. We believe a hawkish surprise is less likely because most market participants expect Powell to be somewhat aggressive. Before we can fully concentrate on Jackson Hole, there is plenty of data to digest. Personal income in July rose 0.2% month over month, failing to meet estimates of a 0.6% increase. Personal spending also missed rising only 0.2% m/m, off the median estimate of 0.4%. The PCE Deflator, the Fed’s favored inflation metric, showed some bright signs for the economy. The headline reading showed that inflation fell 0.1 percent in July. The year-over-year print also game underestimates at 6.3 versus 6.4%. The so-called core readings were also slightly lower than expected. University of Michigan consumer confidence print is due out at 10 a.m.

What to Watch Today…

- Powell Speech at 10 a.m.

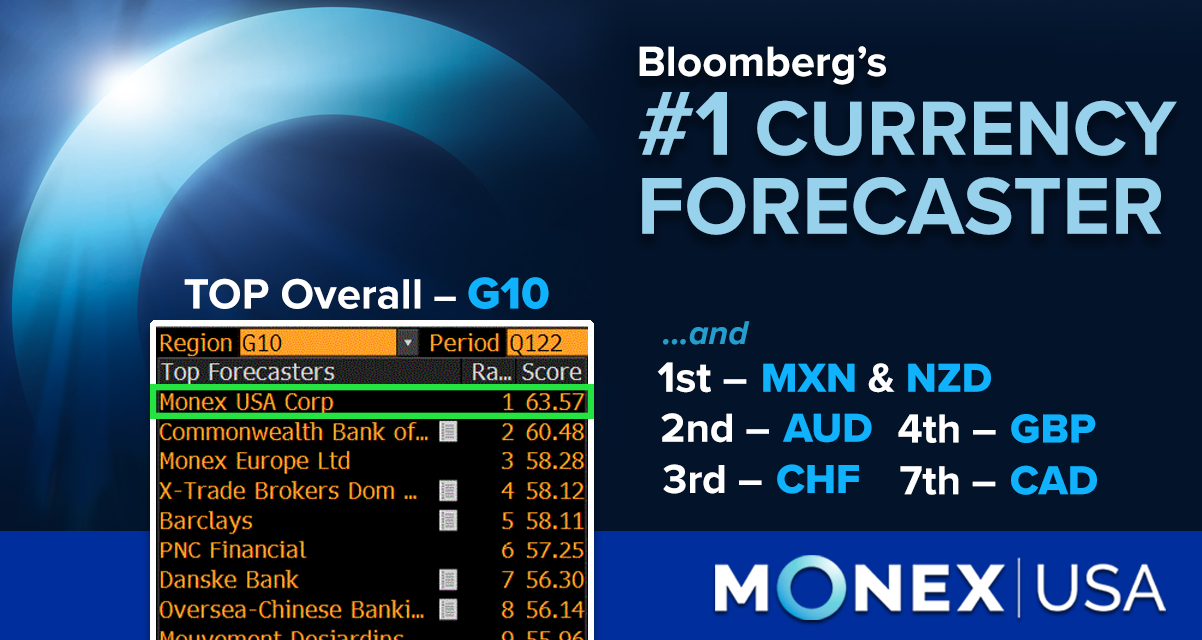

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

EUR

The Euro gained overnight and is continuing its positive momentum this morning as traders position themselves before major economic events in the U.S. Data from the Eurozone was mixed, with differing levels of consumer confidence shown throughout the region. With EUR/USD continuing to see-saw near a major technical and psychological level, today’s speech from Powell may be worth the hype. A decisive pivot one way of the other could strongly dictate the direction of EUR/USD over the coming weeks.

CAD

The Canadian dollar is up a touch today but is well within recent ranges. The pop higher is likely the result of higher oil prices. WTI crude futures have risen 1.1% this morning. There is no major economic data on the Canadian docket today, so loonie traders will join the crowd awaiting Powell’s speech.