The U.S. Dollar is trading in slightly more favorable ranges to close out the last week of the year.

Overview

After a long year of a revitalizing economy, the Buck is ending 2023 with its worst annual performance since the COVID-19 pandemic started. Indeed, expansion throughout the year made it so that higher borrowing costs did not deflate the recovery and actually helped risk appetite. The S&P 500 Index is only a few points away from reaching its all-time high.

We are going into January hopeful that momentum is on the side of an economy that does not deviate from the growth seen this year and believing that while there will be plenty of speculation over a pivot to looser monetary policies, we will have a year of moderation and likely one that will hurt the dollar, but not cause it to decline in value as rapidly as it did this year. Volatility will be highest during times of elections across many regions, and key players will see changes in the guard.

What to Watch Today…

- No major economic releases are scheduled for this week

- Monex USA Online is always open.

- Monex USA office closed on Monday, January 1st

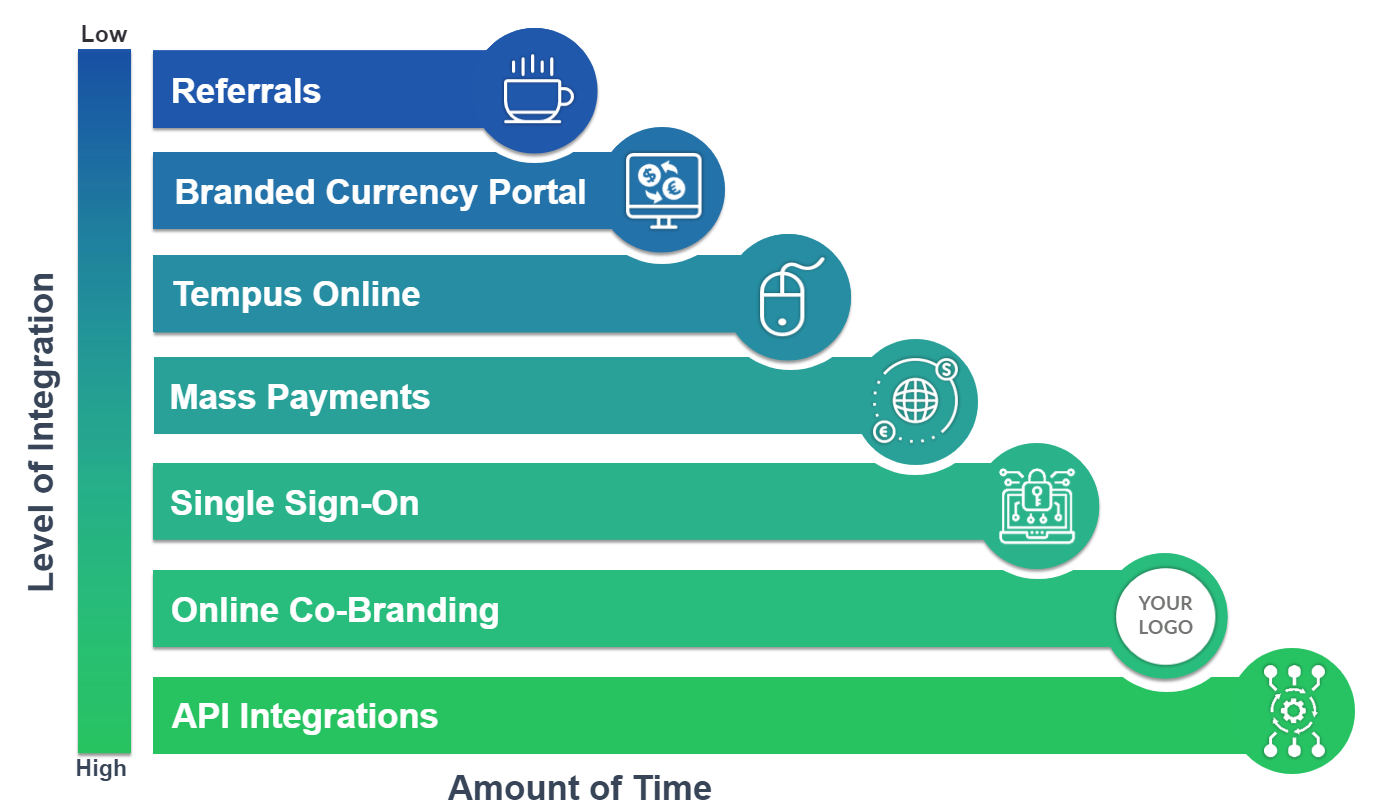

Discover the flexibility of partnering with Monex USA— we provide your desired level of FX support and integrations based on your current and future needs. All levels of our FX solutions are designed to save your business time and money and to exceed your expectations for transacting globally. Learn more