The U.S. dollar is mostly unchanged from yesterday’s close, holding on to the gains seen yesterday morning.

Overview

U.S. equity futures have softened a bit in early trading following disappointing data and the dollar has weakened a touch.The economic docket flashed more warning signs this morning. The third reading of first-quarter GDP registered at -1.6%, down from the previous estimate of -1.5%. The annualized rate remains strong with a 6.9% increase. Personal consumption rose 1.8% in Q1, down from 2.5% in the fourth quarter of 2021.The main event on today’s docket is the European Central Bank’s conference which we expand upon in the Euro section below. We will remain conscience of end-of-month flows over the next two days. Liquidity is likely to dry up on Friday ahead of the holiday weekend and as Europe signs off. U.S. Markets are closed next Monday in celebration of Independence Day.

What to Watch Today…

- No major economic events scheduled for today

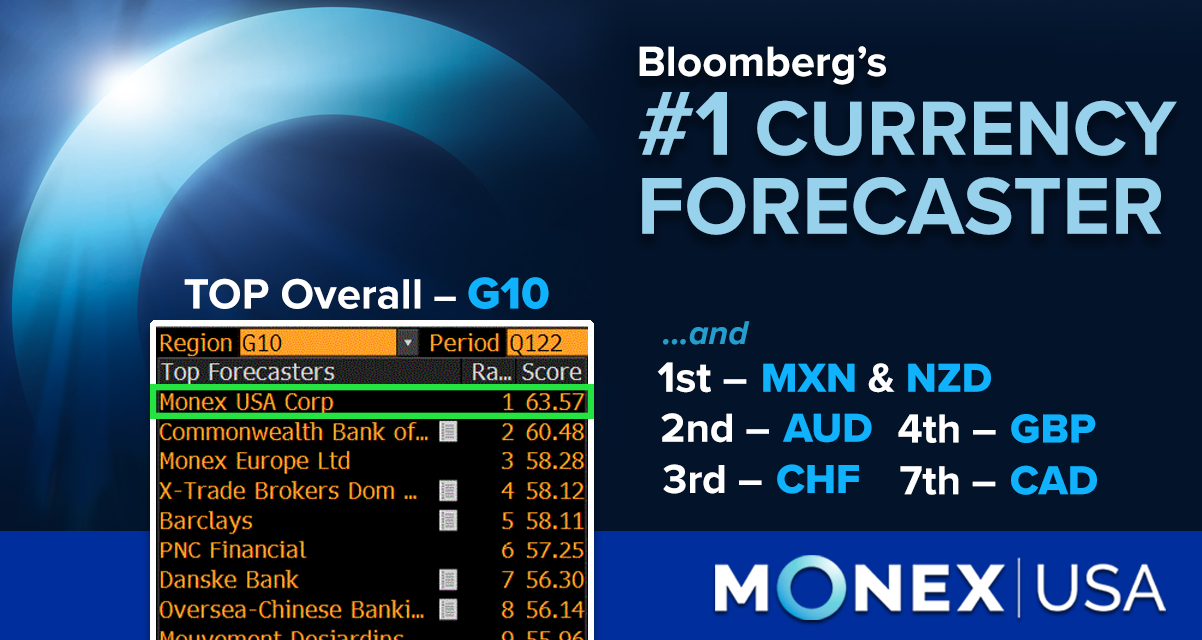

Back to Back TOP Wins | #1 G10 Forecaster for Q1 2022

Bloomberg ranks Monex USA (formerly Tempus) as the top G10 Forecaster, NZD, CHF, AUD, MXN, and GBP! Learn More

EUR

After falling yesterday morning, EUR/USD is seesawing this morning. The Euro quickly fell below a major level overnight but quickly rebounded so you will be forgiven for not noticing any meaningful change. Traders have been position-squaring ahead of a massive panel event in Sintra, Portugal. European Central Bank President Christine Lagarde, U.S. Federal Reserve Chief Jerome Powell, Bank of England Governor Baily, and Bank of International Settlements will speak about monetary policy at an event that starts at 9:00 a.m. Eastern. Expect jerky market reactions in the coming moments.The economic docket showed a mixed picture of inflation in the Eurozone. Generally, Germany’s prints came in lower than expected. But Spain’s inflation rose to 10.0%, far exceeding estimates. The Swiss Franc rose to parity against the Euro for the first time since March.

CAD

The Canadian dollar is set for its fourth day of modest gains as the price of oil crept higher. WTI is now above $113 a barrel and up 1.2% today. There is no major economic data slated in Canada for today so the move is likely solely the result of the uptick in the price of oil. Indeed, other petrocurrencies such as the Norwegian krone are enjoying support during today’s session.